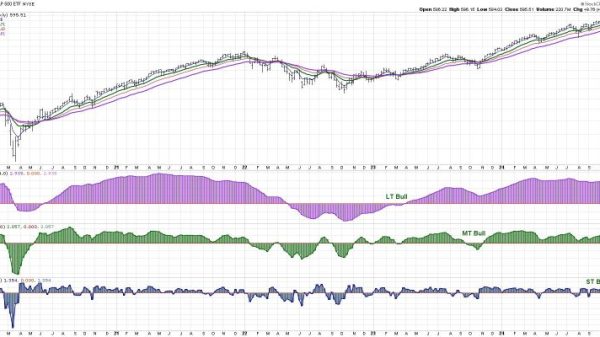

The Indian equities experienced a notably eventful previous week, marked by a fresh lifetime high and a subsequent decline of over 400 points within the same week. Over the past five sessions, the Nifty 50 index fluctuated within a 693.80-point range before closing with a net weekly loss of 426.40 points (-1.86%).

As the markets open on Monday, they are expected to react positively to the exit polls indicating the BJP securing 350-370 seats, suggesting that the current government will retain power for a third term. On Tuesday, the markets will continue responding to the election results. These events are anticipated to induce heightened volatility and wider market swings than usual. Given the potential for market gaps and increased volatility, we are issuing this note in place of our regular weekly outlook.

In light of these significant external events, focusing solely on resistance and support levels may be less relevant, as markets often defy these levels during such times. Instead, it is more useful to consider the potential range of market movements.

Examining the Options Data for Nifty’s 06JUN expiry reveals maximum Call OI built-up at the 23000 and 23500 levels, with significant Put OI at the 21900-22000 levels. This suggests that, in a worst-case scenario, Nifty’s upside potential could reach 23000 or 23200 levels, while downside support may be found at 21800-22000 levels.

It is crucial to understand that Options Data is neither a leading nor lagging indicator. It is coincident data that reflects the current market situation and is subject to change. This data provides situational awareness and helps in forming a broader market perspective.

Given the strong positive reaction to the exit polls and subsequent election results, the best approach is to vigilantly protect profits at higher levels, as the markets may still experience some profit-taking after a day or two of strong positive reactions. Fresh aggressive buying should be considered if Nifty convincingly moves past its previous high. Until then, it is prudent to stay invested in stocks demonstrating strong relative strength while vigilantly protecting profits at higher levels.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst