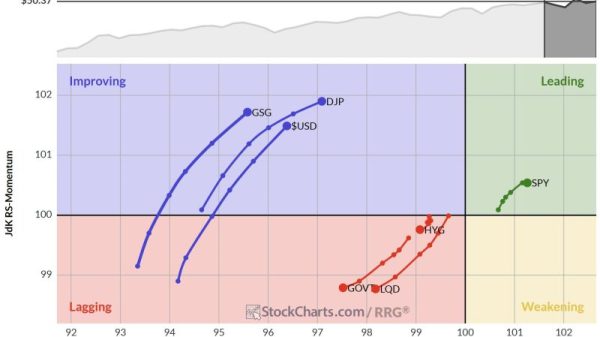

Both the S&P 500 and the NASDAQ are sitting at new highs as we wind down a very positive earning season. So far, almost 80% of S&P 500 companies have reported a positive earnings surprise, with the year-over-year earnings growth rate at the highest level since Q2 of 2022.

Amid this corporate growth, we’re now seeing interest rates pull back following Wednesday’s core CPI data, which came in lower than expected. In response, the yield on the key 10-year treasury bond fell to as low as 4.3% before ticking higher into today’s close.

This is great news for growth stocks such as Technology, which have been struggling as the markets march to new highs. A rising rate environment is a negative for growth stocks such as Technology.

Daily Chart of Technology Sector (XLK)

While Apple’s (AAPL) 12% advance following the release of their earnings 3 weeks ago is certainly a factor in Technology’s new uptrend, a reversal in both Semiconductor and Software stocks this past week is poised to be the latest driver.

As subscribers to my MEM Edge Report are aware, I’ve been on the lookout for renewed interest in these high growth areas, as our watchlist had top Semi and Software names that have now been added to the suggested holdings list.

Daily Chart of Semiconductor Group (SOXX)

Daily Chart of Software ETF (IGV)

Next week could prove to be pivotal for these groups amid earnings reports from key players. Most impactful will be Nvidia (NVDA), which is due to report earnings next Wednesday after the markets close. Going into the report, analysts are anticipating significant revenue growth, driven primarily by their data center segment due to AI demand.

Among Software stocks, Palo Alto (PANW) is due to release their quarterly results after the market closes on Monday. The Software Security stock is recovering from a gap down in price after their last quarterly report, where management announced a product release shift. PANW has entered a new uptrend as it moves closer to closing its gap lower.

Other non-growth sectors have also been moving into favor amid increased AI growth prospects and a lower interest rate possibility. If you’d like to be tuned into these newer areas, as well as the stocks best positioned to take advantage, use this link here to trial my twice-weekly MEM Edge Report for a nominal fee.

Warmly,

Mary Ellen McGonagle

MEM Investment Research